Generative Engine Optimization for Regulated Industries: FinTech Edition

Generative engine optimization helps FinTech firms in regulated industries boost visibility, ensure compliance, and balance innovation with strict rules.

Navigating regulated industries requires careful attention, especially in FinTech. Here, rules and innovative ideas intersect. Generative engine optimization (GEO) plays a crucial role by enhancing how companies utilize AI systems. Research indicates that effective use of GEO can boost AI search visibility by 40%. Early FinTech adopters report that 32% of their valuable sales leads originate from AI searches. These statistics highlight GEO’s significant influence. It aids in business growth while adhering to stringent regulations.

Key Takeaways

Generative engine optimization (GEO) helps AI get noticed 40% more. This helps FinTech companies gain more customers.

Following Google's E-E-A-T rules builds trust and boosts rankings. This is very important for following rules in strict industries.

GEO handles rule-based tasks automatically, cutting mistakes and saving time. This helps keep trust in FinTech strong.

Adding schema and metadata makes content easier to find. It also helps search engines understand and follow the rules.

Working with regulators and partners improves GEO plans. This keeps things legal and encourages new ideas.

Understanding Generative Engine Optimization in Regulated Industries

Core principles of generative engine optimization

Generative engine optimization (GEO) is based on key ideas. It focuses on understanding what users want when they search. Instead of just matching words, it looks at the reason behind the search. This helps provide answers that users find helpful and clear.

Another important idea is following Google’s E-E-A-T rules. These stand for Experience, Expertise, Authoritativeness, and Trustworthiness. Using these rules makes your content more reliable and improves its ranking. For example, adding trusted sources and useful facts can increase visibility by 40%.

Customizing strategies for specific industries is also crucial. Regulated fields like FinTech need special methods because of strict rules. By improving keywords and organizing metadata, you can make your content easier to find online.

Principle | Description |

|---|---|

Understand Search Intent | Focus on what users need and why, not just keywords. |

Meet Google’s E-E-A-T Standards | Follow rules to make content trustworthy and rank higher. |

Evaluated Tactics | Use methods like better keywords and trusted sources to improve visibility. |

Visibility Improvements | Adding facts and sources can boost visibility by 30-40%. |

Domain-Specific Optimization | Different industries need unique strategies for better results. |

By following these steps, you can meet user needs and follow rules.

Why GEO is essential for regulated industries

Industries like FinTech have strict rules to follow. GEO helps businesses stay visible while meeting these rules. It ensures your content matches regulations and stays competitive.

Trust is very important in these industries. GEO builds trust by making sure your content is accurate and clear. Following E-E-A-T rules not only improves rankings but also shows users your information is reliable.

GEO also helps businesses grow. As your company expands, GEO keeps your content ready for both search engines and rules. This is important in industries where rules and user needs change quickly.

Using GEO helps balance following rules and reaching business goals. It’s a key tool for long-term success in regulated industries.

GEO’s relevance to FinTech: Opportunities and challenges

In FinTech, GEO brings many benefits. It saves time by automating hard tasks and offers personalized services. For example, GEO can give users financial advice based on their needs. This makes users happy and helps your business compete.

GEO also helps with better decisions. Using good data, you can create smart plans that meet goals and follow rules. It also lowers costs by making processes faster and using resources wisely.

But GEO in FinTech has challenges too. Keeping data private and safe is a big concern. You must follow data protection laws to avoid problems. Being clear about how AI works is also important. Users and regulators want to know how content is created and ranked.

Ethics are another challenge. AI bias can lead to unfair results, hurting trust. FinTech experts and regulators need to work together to solve these issues.

Opportunities | Challenges |

|---|---|

Keeping data private and secure | |

Personalized services | Explaining how AI works clearly |

Better decision-making | Avoiding unfair AI outcomes |

Automating hard tasks | Working with experts and regulators |

Lowering costs | Protecting AI systems from misuse |

Creating smart strategies | Following strict rules |

Using high-quality data | Building strong technical systems |

By knowing these benefits and challenges, you can use GEO effectively while handling FinTech’s complexities.

Using GEO for Following Rules and Driving New Ideas in FinTech

Using AI to Follow Rules Better

Generative engine optimization (GEO) helps you follow rules easily. AI can handle rule-checking tasks, cutting down on mistakes. For example, a big bank used AI to lower errors by 40%. This made their work more accurate and built trust with others.

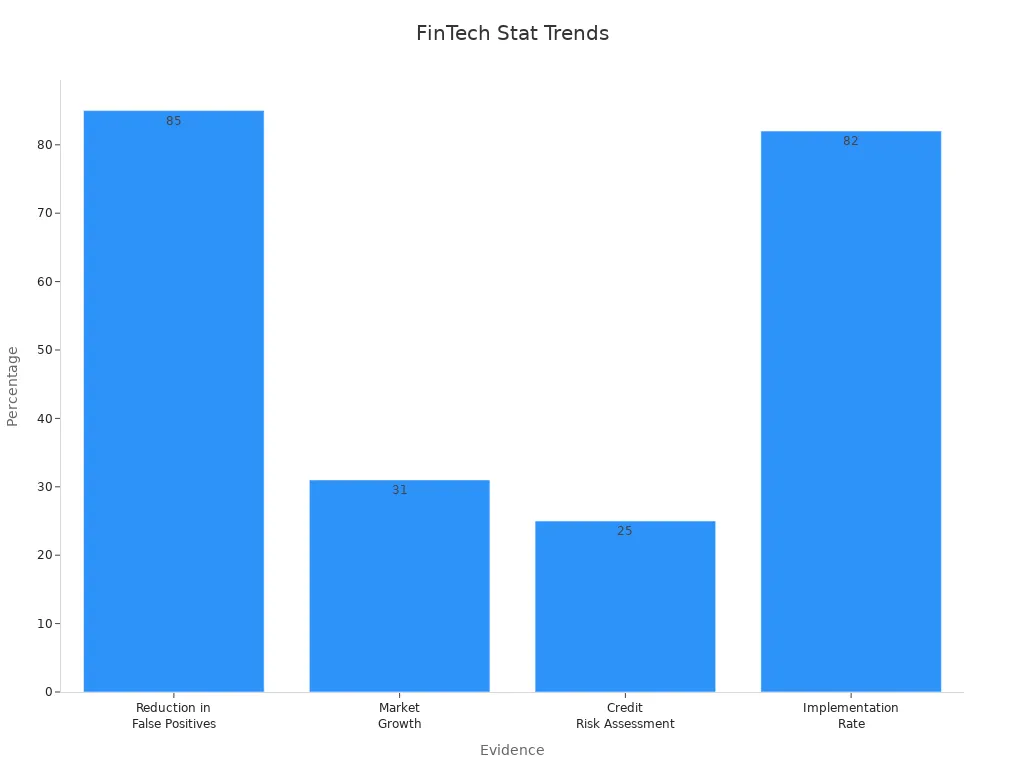

AI also makes spotting fraud better. It can guess fraud before it happens and adjust to new tricks. Visa used AI to cut false alarms by 85%, making fraud checks more accurate. These tools show how GEO turns rule-following into a smart and smooth process.

Type of Business | Rule-Following Improvement | Error Fix/Result |

|---|---|---|

Large Bank | Fewer mistakes in rule-checking | Over 40% fewer errors |

Health Company | Better at keeping data private | Improved care for patients |

Mixing New Ideas with Following Rules

In FinTech, mixing new ideas with rules is key. GEO helps you add rule-following steps early, saving time and money later. AI can improve credit checks by 25%, helping you lend smarter while following rules.

Being quick and flexible is important for new ideas. Treat rules as guides for safe growth. This way, you can create new tools that follow rules and stay competitive.

Growing Bigger and Working Smarter in FinTech

Growing and working faster is important in FinTech. GEO helps sort and study financial papers quickly. This speeds up decisions and improves risk checks. For instance, AI cut problem-spotting time from 24 hours to 5 minutes, letting teams act fast.

Task | Improvement |

|---|---|

Refreshing system times | 92% faster (72 hours to 6 hours) |

Spotting problems | 99% faster (24 hours to 5 minutes) |

Updating data | Over 100% faster (48 hours to 8-24 hours) |

With GEO, you can work faster, learn from big data, and make customers happier. These changes help your business grow while staying efficient and following rules.

Best Practices for Generative Engine Optimization in Regulated Industries

Structuring content for compliance and optimization

To do well in regulated industries, organize your content carefully. Make sure it meets rules and answers user questions clearly. Arrange your content to directly solve user problems. Use tools like schema markup and Q&A formats to make it easier to find. For example, using long-tail keywords with four or more words can help AI show summaries. This boosts how often people see and interact with your content.

Adding ethical practices to your content plan is also key. Keep records of how you train AI and where data comes from. This helps track mistakes and shows you are responsible. It builds trust with both regulators and customers. By keeping clear records, you prove your commitment to using AI responsibly.

Best Practice | Description |

|---|---|

Structured Content | Organize content to answer user questions using schema and Q&A formats. |

Ethical Practices | Record training steps and data sources to track mistakes and build trust. |

Long-Tail Keywords | Use keywords with 4+ words to help AI create summaries. |

Using schema and metadata to improve visibility

Schema and metadata are great tools to make your content easier to find. They give structure and meaning to your content, helping search engines understand it better. For instance, metadata systems can tag sensitive information automatically. This keeps your content within rules while improving search rankings.

Schema and metadata do more than just improve visibility. They make data better, save time, and cut storage costs by removing extra copies. Metadata also helps organize files, making it faster to find what you need. For example, automated systems can track where data comes from, ensuring it follows rules and stays clear.

Benefit | Definition |

|---|---|

Better Data Quality | Ensures only good data is stored and used. |

Tags sensitive data and tracks its history automatically. | |

Faster Work | Makes finding documents quicker and easier. |

Building transparency and auditability into AI systems

Making AI systems clear and easy to check is very important. Your AI should not only work well but also be understandable. Keep records of how your AI creates content and makes choices. This builds trust with both regulators and users. Clear reports can show mistakes or biases, helping you stay fair and follow rules.

Using Objectives and Key Results (OKRs) can make your AI plans more transparent. OKRs link your goals to measurable results, keeping teams accountable. For example, a company might aim for 95% use of a new system. This could reduce errors and make customers happier.

Tip: Make transparency a key part of your AI plan. By keeping records and clear audit trails, you can handle rules better and still innovate.

Overcoming Challenges of GEO in FinTech

Balancing innovation with strict regulatory requirements

FinTech companies must balance new ideas with strict rules. Start by including compliance steps in your processes early. This helps avoid problems later on. Using RegTech tools can make rule-following easier and faster. For instance, automated systems can quickly spot rule-breaking transactions. This keeps work smooth and reduces mistakes.

Getting advice from legal experts is also helpful. They guide you through changing rules and prevent costly errors. Keeping track of new regulations helps your company stay flexible. By teaching all teams to follow rules, you lower risks and build a strong base for growth.

Tip: Think of rules as helpful guides, not roadblocks. This way, you can create new ideas while staying within the law.

Addressing data privacy and security concerns

Keeping data safe is very important in FinTech. Strong encryption protects private information when it’s sent or stored. Even if someone gets the data, encryption keeps it safe. Strict access controls make sure only approved people can see sensitive data.

Watching systems in real-time and doing regular checks help find and fix problems fast. Using data anonymization lets AI learn from data without risking privacy. These steps keep your generative engine secure and build trust with users.

Mitigating algorithmic bias and ethical risks

Bias in algorithms can cause unfair results and hurt trust. To fix this, use diverse data to train AI fairly. Regular checks of AI systems can catch and fix bias early. Explaining how your generative engine works also helps users trust it.

Set clear rules for using AI that match industry standards and your values. Focus on fairness and responsibility to avoid ethical problems. This not only reduces risks but also improves your company’s reputation in FinTech.

Actionable Framework for Adopting GEO in FinTech

Building a compliance-first GEO strategy

A compliance-first plan ensures your generative engine optimization follows rules and grows your business. Start by creating strong rules and internal AI policies. These rules guide fair AI use and follow laws like the Digital Personal Data Protection Act, 2023. Adding compliance to your GEO plan lowers risks and builds trust with others.

Match your AI goals with business needs to encourage teamwork and new ideas. For example, flexible methods help you adjust to rule changes while staying ethical. Regularly checking your GEO steps keeps them useful and within the rules.

Outcome Type | Description |

|---|---|

Authority Building | Expert-made, rule-following content builds trust and brand strength. |

User Growth | SEO-friendly pages for products and services attract more users. |

Regulatory Compliance | SEO foundations ready for YMYL rules ensure legal alignment. |

Visibility Expansion | Secure visibility grows on Google, fintech sites, apps, and AI tools. |

User Engagement | Actions like sign-ups and app installs boost user loyalty. |

Transparent Reporting | SEO results tied to growth provide clear reports for investors. |

Tip: Think of compliance as a helpful base, not a barrier. Focusing on it helps you meet rules and succeed in business.

Working with regulators and industry partners

Teaming up with regulators and industry partners makes your GEO plan stronger. Talking openly with regulators keeps you updated on changing rules. Regular meetings ensure your AI systems meet standards and avoid legal trouble.

Work with industry partners to share ideas and solve problems together. Partnerships with other fintech companies can create shared fixes for common issues. For example, teamwork can reduce AI bias or improve data safety.

Unordered list of steps for teamwork:

Build connections with regulators to stay informed about rule changes.

Join industry groups to learn and share knowledge.

Create joint projects to solve ethical and technical problems.

Note: Teamwork isn’t just about following rules. It also leads to new ideas and shared success.

Investing in scalable AI systems for better optimization

Scalable AI systems are key for effective generative engine optimization. They help you handle growing needs and keep systems running smoothly. Spending on strong systems lowers costs, speeds up work, and boosts performance.

For instance, Flexential’s advanced setups support high power use, perfect for AI tasks. Their data centers in 18 U.S. locations improve flexibility and scaling for AI projects.

Benefit | Description |

|---|---|

Reduced Costs | Strong AI systems cost less than older IT setups. |

Increased Scalability and Flexibility | Scalable systems adjust easily to changing needs. |

Greater Performance and Speed | Better systems process faster and work more efficiently. |

Enhanced Collaboration | Good AI systems improve teamwork across teams. |

Better Compliance | Strong systems help meet legal requirements. |

Effective Use of Generative AI | Advanced systems make the most of generative AI tools. |

Tip: Scalable systems not only meet today’s needs but also prepare your fintech business for future growth and success.

Generative engine optimization (GEO) is changing FinTech by improving visibility, following rules, and sparking new ideas. Its power comes from adjusting to search changes and making financial tasks easier.

Key Points:

Old measures like website clicks matter less as search engines give direct answers.

Businesses should aim for their brand to appear in AI-generated results to get more customers and sales.

Generative AI makes payments faster and smoother, supports open banking, and creates digital money tools.

Keeping up with rules while growing and trying new ideas helps businesses last. GEO can help you stay ahead of others and follow the rules. Start using GEO now to find fresh chances in FinTech.

FAQ

What is generative engine optimization (GEO) in simple words?

GEO uses AI to make your content easier to find online. It focuses on what users need, improves visibility, and follows rules. This helps your business stay competitive and trusted.

How does GEO help FinTech companies follow rules?

GEO uses AI tools to check and follow rules automatically. It handles tasks like spotting fraud, tagging data, and checking compliance. This saves time, reduces mistakes, and builds trust with rule-makers.

Can GEO make FinTech customers happier?

Yes, GEO gives services based on what customers like and need. It offers faster help, smarter advice, and better tools for decisions. These changes make customers happy and loyal while following rules.

How does GEO fix bias in AI systems?

GEO reduces bias by using different types of data and checking AI often. It keeps AI fair by making its actions clear and easy to understand. This lowers risks and helps users trust your system.

Can GEO grow with FinTech businesses?

Yes, GEO uses AI systems that can handle more work as you grow. It speeds up tasks like checking documents and risks, helping your business grow while following rules.

See Also

Strategies for Effectively Implementing Generative Engine Optimization

Important Ethical Factors in Generative Engine Optimization

The Significance of Generative Engine Optimization for B2B SaaS

Balancing HIPAA Compliance with Generative Engine Optimization

Effective Methods for Measuring Generative Engine Optimization