October 2025 AI Martech Acquisitions Reshape Competitive Landscape

Major AI marketing tool acquisitions in October 2025—Conga, NTT DATA, Affinity—are reshaping martech. See expert insights and what buyers must do now.

In the first days of October 2025, a wave of acquisitions hit AI-driven marketing and revenue tech—spanning CPQ/CLM, Salesforce implementation services, and affiliate monetization. The common thread: faster AI roadmaps under bigger umbrellas, but also higher vendor concentration, shifting SLAs, and renewed pricing power. If you run growth, RevOps, or marketing engineering, this is a “pause-and-assess” moment—stabilize your integrations, lock in data portability, and prepare a monitoring plan for how these moves affect your revenue workflows and your visibility across AI answer engines.

The deals, at a glance (and why they matter)

-

Conga intends to acquire PROS Holdings’ B2B software business (AI-powered CPQ/CLM/document automation), announced Oct 1, 2025; closing targeted for Q1 2026. See the official details in the Conga press release (Oct 1, 2025), which frames a unified, AI-assisted revenue lifecycle. Parent-level context from Thoma Bravo on the segmentation plan appears in the Thoma Bravo announcement (Oct 1, 2025).

-

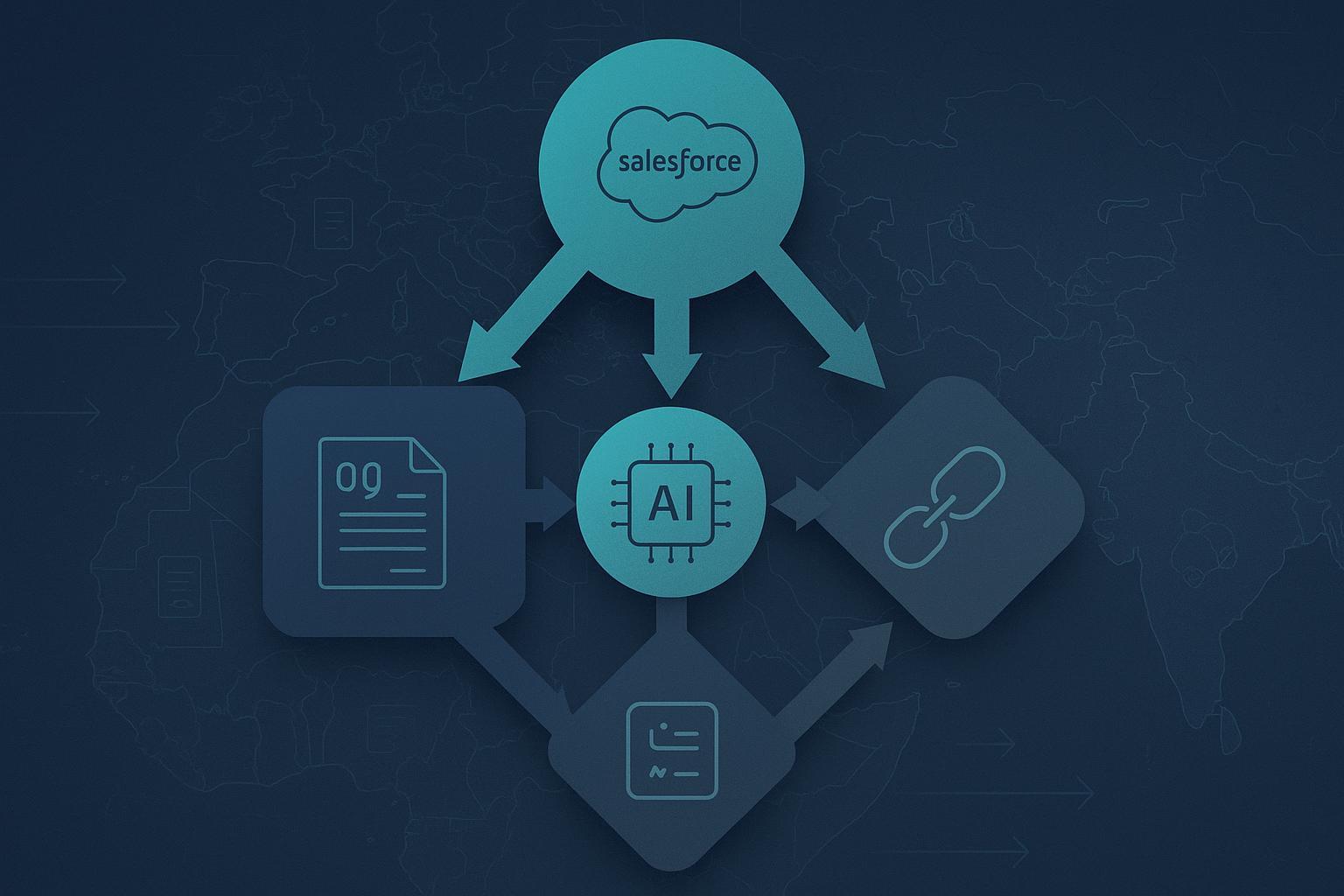

NTT DATA is acquiring EXAH, a Salesforce consulting and AI customer engagement specialist, expanding delivery across Middle East and Africa; announced Oct 2, 2025 in Johannesburg according to the NTT DATA newsroom (Oct 2, 2025). Expect more scale for Salesforce AI implementations, faster rollouts, and stronger regional execution.

-

In affiliate tech, Affinity Global is integrating Affilizz’s AI shopping widgets into its NucleusLinks platform. The official announcement is captured in the NucleusLinks press release (Sept 15, 2025), while trade coverage in early October emphasizes a step-change in publisher monetization.

What’s the signal across all three? Convergence. Quoting-to-cash and contract automation under one roof, Salesforce AI delivery capacity scaling, and affiliate platforms bundling more automation and experimentation. For buyers, this can compress integration timelines—but it also concentrates risk.

Why this consolidation matters for buyers right now

-

Integration continuity: Overlaps between Conga’s existing CPQ/CLM capabilities and PROS’s B2B unit may trigger roadmap triage. Until packaging and migration paths are formalized, assume change is coming—architect for modularity and avoid hard-coding to product-specific idiosyncrasies.

-

Pricing and packaging leverage: Fewer, larger vendors often means stronger pricing power. Time your negotiations for maximum leverage (e.g., near renewal) and request written commitments on feature continuity, SLAs, and data portability.

-

Data governance and portability: Consolidation can simplify data flows—but only if export/import fidelity and identity resolution are preserved. Audit data contracts now and line up backups for your most brittle functions.

-

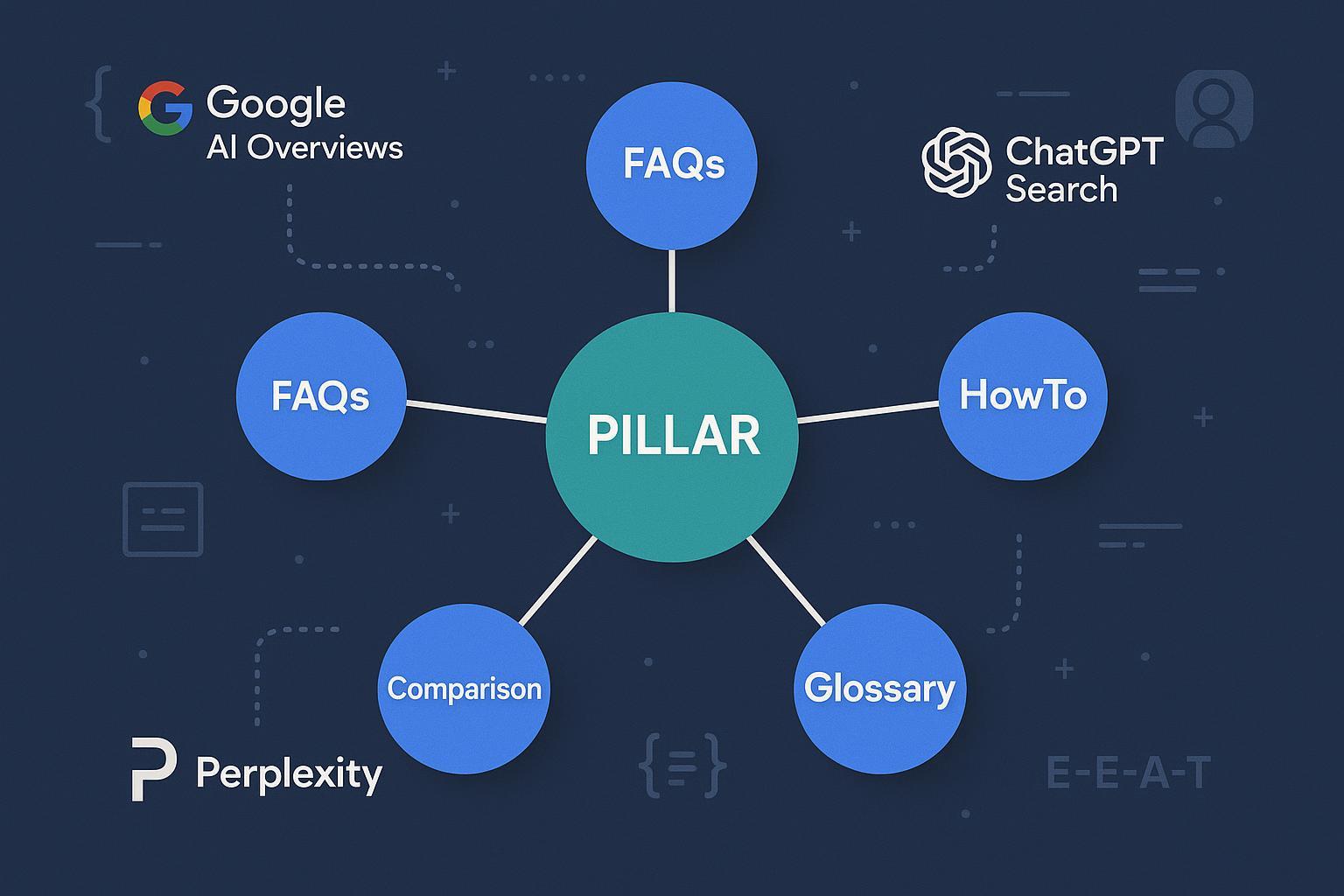

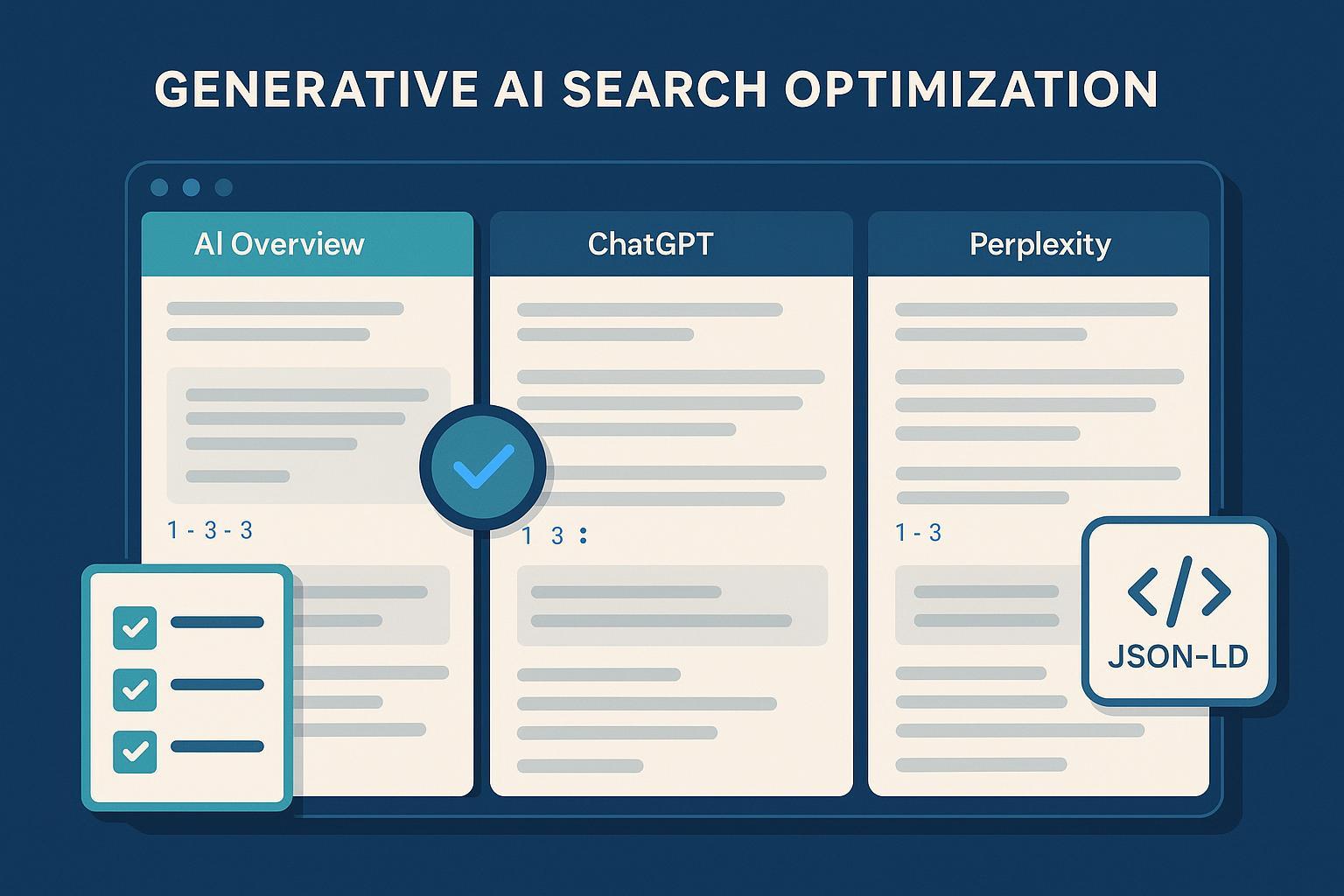

AI visibility dynamics: As platforms consolidate, their content, schema, and distribution behaviors can shift, which may ripple into AI answer surfaces. Ground your team in the basics of Generative Engine Optimization (GEO) so you can recognize and respond to changes in how ChatGPT, Perplexity, and Google AI Overviews describe your brand and link to your properties.

Deal-by-deal implications (with authoritative anchors)

-

Conga × PROS B2B: According to the Conga press release (Oct 1, 2025), the intent is to build an integrated, AI-driven revenue lifecycle. The Thoma Bravo announcement (Oct 1, 2025) clarifies that PROS’s travel unit will be separate while the B2B unit combines with Conga. For customers, the near-term task is to map CPQ/CLM/document automation overlaps and prepare migration playbooks without committing to changes before official roadmaps land.

-

NTT DATA × EXAH: The NTT DATA newsroom (Oct 2, 2025) positions the deal as a boost to Salesforce and AI implementation capacity across MEA. Expect faster deployment cycles, but validate certifications, localization, and data residency requirements during partner selection.

-

Affinity × Affilizz: Per the NucleusLinks press release (Sept 15, 2025), Affilizz’s AI shopping experiences will merge into Affinity’s monetization stack. Publishers and brand-side affiliate teams should stress-test attribution coherence with paid channels and scrutinize fraud controls as automation expands.

Forecasts (clearly labeled): Expect bundling incentives to consolidate under Conga for CPQ/CLM/document automation in 2026, Salesforce AI delivery acceleration in MEA via NTT DATA, and more AI-led creative testing/fraud prevention in affiliate programs. Treat these as directional signals until vendor roadmaps are published.

What to ask your vendor this week

- Can you provide a written statement on support continuity and SLAs for the next 12 months post-announcement?

- Will any SKUs, features, or brand names be sunset, re-bundled, or re-priced? What’s the migration path and timeline?

- How is data portability guaranteed (export formats, API limits, historical retention)?

- Are there changes to sub-processors, data residency, or cross-border transfer terms?

- What sandbox or pilot environments can we access to validate integrations before changes go live?

A practical workflow to monitor impact across AI answer engines

Here’s a lightweight routine teams can run weekly after M&A announcements to detect shifts in how AI systems describe your brand, products, and competitors:

- Define canonical prompts: Brand, product, and category prompts (plus 3–5 competitor variants). Keep phrasing consistent.

- Capture answers across engines: Pull results from ChatGPT, Perplexity, and Google AI Overviews for the same prompts. Log cited domains, sentiment, and recurring claims.

- Track deltas: Note changes in your domain’s presence, competitor mentions, and sentiment direction.

- Investigate drivers: Correlate shifts with vendor roadmap updates, documentation changes, or packaging moves.

- Respond: Update your content, FAQs, and technical docs to clarify facts; brief PR and partnership teams where necessary.

Example tooling: Teams can use Geneo to track AI search visibility across platforms, monitor sentiment over time, and compare historical snapshots for the same prompts. Disclosure: Geneo is our product.

For a sense of how cross-platform benchmarking is presented, see this sample query report format on major regulatory news: Largest GDPR fines in 2025 — sample benchmarking view.

7–30–90 day response plan

-

Next 7 days

- Freeze non-critical migrations in impacted categories (CPQ/CLM, Salesforce integrations, affiliate platforms) until you receive written guidance.

- Open renewal files: Assemble current SLAs, SOWs, and pricing addenda; identify exit clauses and co-termination opportunities.

- Run a single source of truth audit: Map quoting-to-cash and campaign analytics to see where acquired vendors are linchpins.

-

Next 30 days

- Build an integration diagram for Salesforce data flows (CDP, lead routing, enrichment, quoting, contracting, billing). Flag brittle customizations.

- Start continuous monitoring of AI answer visibility and sentiment on core prompts; document baseline and weekly deltas.

- Draft negotiation playbooks: Define “asks” (roadmap commitments, sandbox access, migration credits) and “walk-away” points.

-

Next 90 days

- Pilot redundancies for high-risk functions (backup quoting engine, alternative affiliate tracker). Rehearse export/import and cutover.

- Implement governance for AI-driven changes: version prompt templates, record model updates from vendors, and set review cadences.

- Validate reporting parity after any bundle or API changes to prevent silent KPI drift.

Segment-specific guidance

-

B2B revenue tech (Conga–PROS B2B)

- Prepare a side-by-side of CPQ/CLM features where you have overlap; identify critical automations that cannot break during migration.

- Avoid irreversible customizations until Conga publishes an integration roadmap; build adapters or abstraction layers where feasible.

-

Salesforce ecosystem (NTT DATA–EXAH)

- For MEA deployments, ensure partner SLAs match your localization, compliance, and data residency needs; examine certification depth and reference architectures.

- Use pilot waves to validate AI-enabled engagement features before scaling.

-

Affiliate marketing (Affinity–Affilizz)

- Stress-test attribution and fraud detection as new AI widgets and routing automations are introduced.

- Align creative testing cadence with merchandising and paid media so optimization signals don’t conflict.

Signals to monitor (and when to update your plan)

- Official integration roadmaps, SKU/packaging changes, and any feature sunsetting notices

- Leadership changes and support model shifts; watch SLA adherence and ticket volume trends

- Visibility and sentiment changes in AI answers for your brand and category

- Contract notices around pricing or term changes; new AI add-ons or credits

We will update this analysis when vendors publish definitive product unification plans, regulatory approvals land, or pricing/packaging changes are announced.

Source notes and corroboration

- Conga’s intent to acquire PROS B2B unit (Oct 1, 2025): Conga press release

- PROS segment plan under Thoma Bravo (Oct 1, 2025): Thoma Bravo announcement

- NTT DATA acquires EXAH (Oct 2, 2025): NTT DATA newsroom

- Affinity acquires Affilizz (Sept 15, 2025): NucleusLinks press release

- Additional context on the Conga–PROS move (Oct 1, 2025): Digital Commerce 360 coverage

Next steps

- Socialize this briefing with your RevOps, Legal, and Security teams; capture questions for your vendors and partners.

- Establish continuous monitoring for AI answer visibility and sentiment so you can catch narrative shifts early. If you need a purpose-built workflow, you can evaluate tools like Geneo for this monitoring in parallel with your integration reviews.

—

Change log: First published Oct 2, 2025. We will refresh as official roadmaps, close dates, and packaging changes are announced.