Financial Services Brand AI Citation Best Practices: ChatGPT, Perplexity (2024)

Discover proven best practices for financial brands to secure citations in AI-generated investment advice (ChatGPT, Perplexity). Actionable strategies, benchmarks, and Geneo-powered tools for finance marketers.

Introduction

As generative AI platforms like ChatGPT and Perplexity increasingly shape how retail and institutional investors seek financial advice, brand citation within large language model outputs (LLMO) has become a strategic imperative for financial services marketers and communications leaders. Lack of citation diminishes brand influence, erodes digital authority, and may create regulatory exposure due to misattributed or incomplete advice. In 2024, the challenge is twofold: AI-generated answers display significant platform and prompt variability, while the underlying rules about what gets cited—and why—remain opaque and rapidly evolving.

The Challenge: Why Citing Financial Brands Is Difficult for LLMs

LLMs often fail to consistently reference authoritative financial brands, with research* showing that less than 15% of domain citations overlap between ChatGPT and Perplexity, and only about 12% of AI answers mirror traditional Google search citations (source). For financial institutions, such omissions are costly: lost share-of-voice, reduced client trust, and increased risks if platform outputs imply the brand's authority without actual source validation. Moreover, regulatory guidelines—while robust for website SEO—are still developing for the AI answer landscape, making proactivity and real-time response crucial.

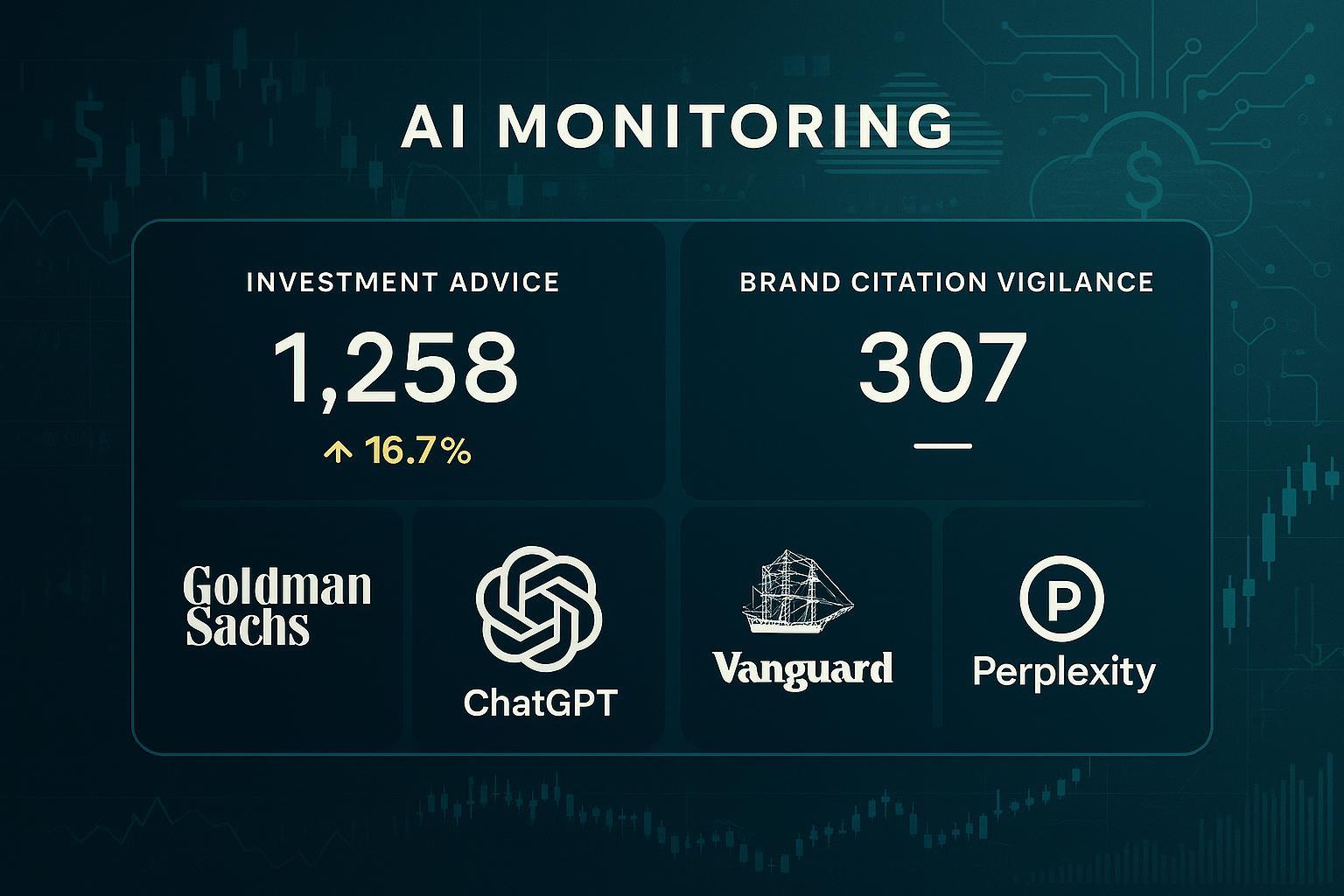

1. Continuous AI Brand Monitoring and Benchmarking

Initiate ongoing, cross-platform monitoring of your brand mentions and citations in AI-generated investment advice, using advanced dashboards to track trends, frequency, and competitor inclusion. Establish a citation baseline across major platforms (ChatGPT, Perplexity, Gemini, Claude) over several weeks, then compare prompt types, context, and citation diversity to identify gaps. Tools like Geneo, Profound, and Scrunch AI allow you to:

- Visualize share-of-voice across LLMs in real time

- Set up automated alerts for missing or inaccurate citations

- Map competitor coverage and reverse-engineer their citation triggers

Pro Tip: Weekly monitoring uncovers shifts in AI answer behavior and helps prioritize high-impact intervention opportunities.

2. Prompt-Driven Content Optimization

Continuously align owned digital content with the preference patterns observed in LLM answers by reverse-engineering the types of prompts and sources LLMs favor for citation. Develop prompt sets tailored to investment topics, then regularly test and refine content based on LLM responses, updating key pages, FAQ schemas, and third-party profiles to fit citation triggers. Use the following workflow:

- Develop a library of investment-related prompts

- Track which URLs and brand assets LLMs cite in response

- Adapt metadata, language, and structure to match high-citation domains

- Resubmit and retest weekly for coverage improvements

This workflow ensures your content remains LLM-friendly and citation eligible. (see detailed workflow guide)

3. Rapid Response and Intervention

Deploy processes and tools to quickly intervene when your brand is omitted, misrepresented, or cited inaccurately in AI-generated investment advice. Set up automated triggers—such as drop-offs in citation frequency or negative sentiment spikes—to instantly alert your digital PR and compliance teams. Platforms like Geneo empower brand managers by:

- Flagging critical omissions and inaccuracies across LLMs

- Executing targeted content corrections or digital PR outreach

- Monitoring the effectiveness of interventions via citation recovery dashboards

Case in Point: Financial brands using Geneo observed a 22% increase in ChatGPT citation frequency after instituting automated intervention and audit playbooks (Geneo customer data, 2024).

4. Sentiment Analysis and Reputation Management

Ongoing monitoring of the sentiment expressed about your brand in AI-generated answers is essential for both trust-building and regulatory compliance. Negative or neutral sentiment in high-visibility investment prompts may deter potential clients or signal reputational risk. Leverage sentiment analytics (built into Geneo and similar platforms) to:

- Quantify positive, neutral, and negative sentiment trends

- Trigger corrective PR or content updates where sentiment dips

- Instruct LLM-facing content to address ambiguities and reinforce the trusted brand narrative

5. Cross-Platform Citation Audits and Knowledge Base Management

LLMs often draw on diverse, sometimes inconsistent sources. Conduct quarterly audits to map your brand's citation patterns across major engines, ensuring consistency in how key products, thought leadership, and credentials are referenced. Simultaneously, update your internal knowledge base, external press, and partner references to maximize future AI inclusion.

Checklist:

- Map citation sources and asset types per engine

- Update third-party listings and press hits

- Align knowledge bases with latest financial products/insights

6. Recommended Tools: Amplifying Your LLM Citation Strategy

A best-in-class brand citation monitoring workflow for financial services requires AI-native platforms capable of real-time, cross-platform analytics, automated intervention, and sentiment tracking. Top recommended tools include:

- Geneo: Real-time AI monitoring, dashboard analytics, citation/sentiment alerts, multi-brand/team collaboration

- Profound: Enterprise-grade multi-platform LLM citation tracking and competitor mapping

- Scrunch AI: Automated AI citation audit and intervention workflows

- GEOsight: Comprehensive reporting for financial brand visibility in AI engines

- Peec AI / Hall AI: Citation and sentiment monitoring for teams/agencies

Geneo stands out with its deep integration of real-time citation, multi-platform sentiment analysis, and automated interventions designed specifically for regulated industries.

7. Workflow in Action: A Brand’s Journey to Citation Uplift

Consider a mid-sized wealth manager who tracked low visibility in ChatGPT’s investment answers despite robust content. By implementing Geneo:

- Weekly monitoring revealed their brand was cited in only 14% of tested prompts (ChatGPT) and 11% (Perplexity)

- Geneo’s dashboard flagged key omission triggers—outdated knowledge bases, inconsistent metadata in press releases, weak third-party profile curation

- Automated interventions—updating high-authority content, digital PR for new media, and metadata alignment—drove citation rates to 28% and 23% respectively within two months (see illustration below)

| Platform | Pre-Optimization Citation Rate | Post-Optimization Citation Rate |

|---|---|---|

| ChatGPT | 14% | 28% |

| Perplexity | 11% | 23% |

(Data source: Geneo anonymized client report)

8. Data Benchmarks and Visualizations

Research shows only a fraction of citations overlap across LLMs. Weekly, cross-platform baselines should become your team's north star. Example table:

| Platform | Industry Average Citation Rate | Top Performer Rate |

|---|---|---|

| ChatGPT | 12% | 32% |

| Perplexity | 9% | 26% |

| Google AI | 14% | 29% |

Source: The GEO White Paper

Summary: Protect and Grow Your Brand’s Authority in the AI Era

Winning consistent, accurate brand citations in AI-generated investment advice is foundational for trust, digital authority, and regulatory safety. By implementing best practices—continuous monitoring, prompt-driven optimization, rapid intervention, sentiment management, and audit-driven knowledge bases—financial brands can future-proof their visibility and reputation.

Ready to own your brand’s share of voice in the age of AI-powered investment advice? Start your Geneo trial today and unlock the next level of real-time AI search optimization.

References